Key Takeaways

Dividend-paying stocks offer an alternative for income-oriented investors willing to take on equity market risk.

Dividends have constituted nearly 40% of the total return of U.S. stocks since 1930, highlighting the role of dividends in long-term performance.¹

We believe a continued stock market rotation to value would be positive for dividend-paying stocks.

Interest rates hit record lows in 2020 but are rising as the Federal Reserve (Fed) moves more aggressively to tame inflation. Treasury yields have increased this year, and real yields that reflect the impact of inflation are low but rising again after dropping below zero in the first quarter of 2020.

With real yields on Treasuries under pressure, dividend-paying stocks may offer an alternative for income-seeking investors willing to take on stock market risk. Many companies cut or suspended their dividend payouts during the pandemic’s early days. The ensuing economic downturn pressured many dividend-oriented sectors, including energy, financials, consumer discretionary and real estate.

The market rebounded quickly from the downturn, and by the fourth quarter of 2020, dividend payments by S&P 500® companies reached a new record high. Dividends reached another record in 2021, marking the 10th consecutive year of record payouts.² We think dividends of higher-quality companies are stable and continue to offer an attractive alternative to low-yielding bonds.

Recent Rotation From Growth to Value Stocks Includes Dividend Payers

We tend to find dividend-paying stocks in the value-oriented areas of the equity market. Examples include utility and consumer staples companies. Such businesses have historically been more likely to pay dividends than fast-growing companies in cyclical sectors, such as information technology.

After an extended period of underperformance, value stocks have led the market for the last year.³ The rotation back to value began in 2021 as expectations for rising rates and inflation headwinds benefited value sectors of the market relative to growth. Notably, growth leads value when looking at extended periods, and no one can accurately predict whether the recent outperformance of value will be sustained.

Valuation Disparity May Present Opportunities

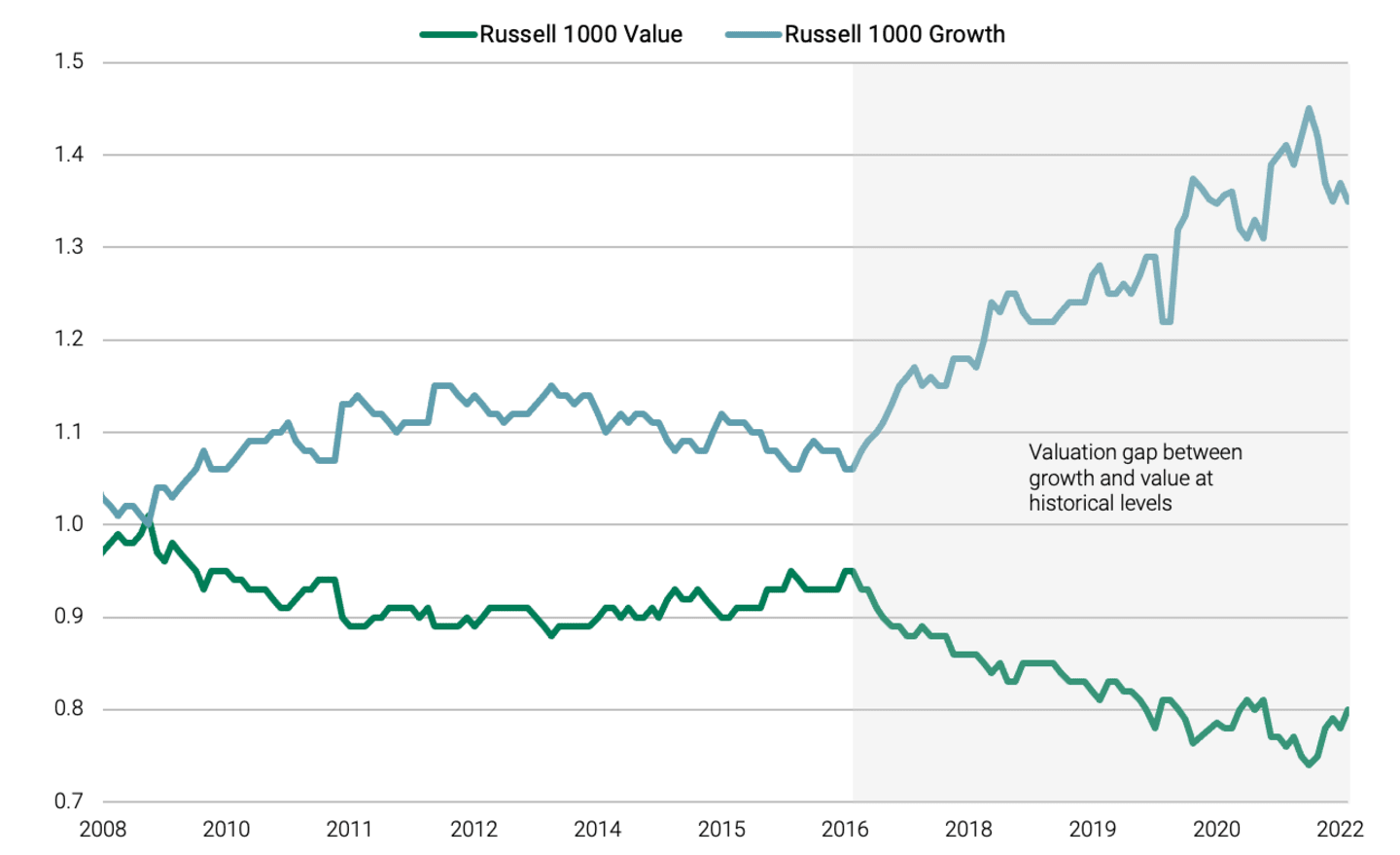

Despite recent performance, there continues to be a wide disparity in valuations between growth and value stocks. As of April 30, 2022, large-cap growth stocks were trading at a price-to-earnings (P/E) ratio of 26.2, while large-cap value stocks were trading at a PE ratio of 15.2.⁴ See Figure 1. In our view, this vast difference in valuations may represent an opportunity for dividend investors.

We think the long period of valuation disparity heightens the chances for the prices of value stocks to increase and the prices of growth stocks to decline. Our experience in prior cycles indicates this reversal of trends can transpire quickly. Investors exposed to value stocks could benefit from the snapback if this occurs.

Figure 1 | Valuations Between Growth and Value Stocks Are at an Extreme

Data from 12/31/2008 – 4/30/2022. Source: FactSet. Russell 1000 Value Index and Russell 1000 Growth Index.

Dividend Reinvestment Taps into the Power of Compounding

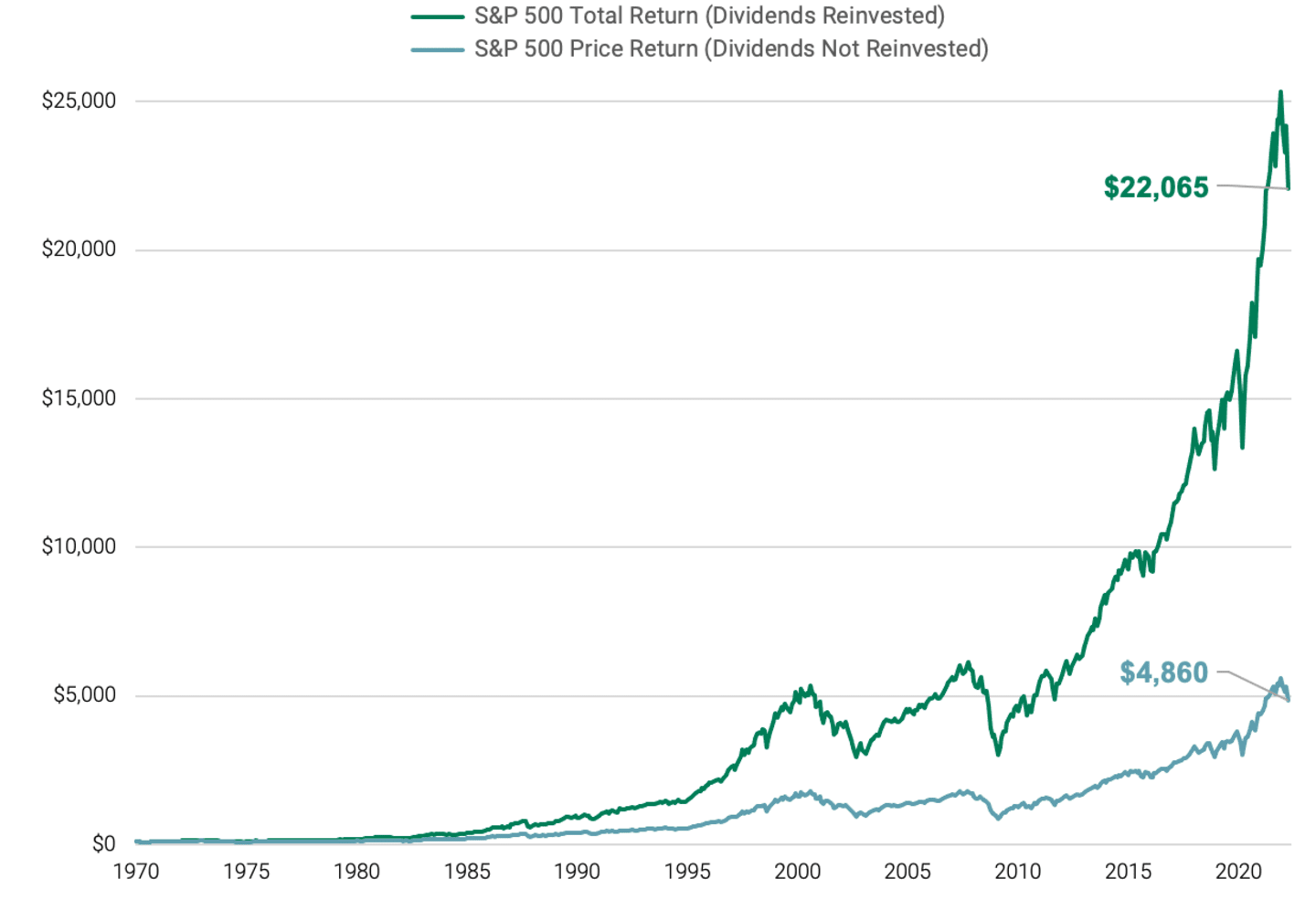

Since 1930, dividends have constituted approximately 40% of the total return of U.S. stocks. Figure 2 shows how vital dividends—and dividend reinvestment—have been to the value of a hypothetical $100 stock investment over 40 years in the S&P 500® Index.

Price appreciation led to a value of nearly $4,860, but reinvested dividends led to a total return of $22,065. That difference of $17,205 is more than four times the price appreciation growth.

Reinvesting regular dividend payments has historically boosted investment returns over time thanks, in part, to the power of compounding. Reinvesting dividends means any future earnings and dividends are paid on a higher share balance.

Figure 2 | The Power of Compounding Has Heightened Investment Returns Over Time

Growth of $100 – Total Return vs. Price Return

Data from 1/31/1970 – 4/30/2022. Source: FactSet. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security.

Dividends May Help Fortify Portfolios

We believe dividend-paying stocks have a place in income-oriented portfolios and offer an alternative to low-yielding fixed-income securities. Dividend payouts have recovered from pandemic-fueled setbacks, and the power of compounding could bolster investment returns over time. We also believe a sustained market rotation from growth to value would bode well for dividend-paying stocks.

Author

Source: Morningstar. Data as of 4/30/2022.

Source: FactSet. Data as of 3/31/2022.

Source: FactSet. Data as of 5/31/2022.

Source: FactSet. Data as of 4/30/2022.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.